Oil Price Rallies Ahead Of Fundamentals

US oil manufacturing averaged ~10 mb/d in May.

But production is about to go back in June in all likelihood lower back to ~eleven mb/d.

We see US oil production recuperating eventually back to ~eleven.five mb/d however current decline quotes will devour into manufacturing after that.

Oil fees are rallying in advance of basics, this means that it will likely be a uneven rebalancing if product storages don't begin drawing soon.

In order to avoid a uneven rebalancing, it desires to be call for led via decrease product storages and higher refinery throughput.

Looking for a helping hand in the market? Members of HFI Research get exclusive thoughts and steering to navigate any climate. Get began today »

Welcome to the ahead edition of Oil Markets Daily!

EIA mentioned a supportive crude garage discern today but the basic report changed into bearish as total beverages hold to build.

Source: EIA, HFI Research

US oil production completed May averaging ~10 mb/d with an normal drop of ~2 mb/d m-o-m. If we don't forget adjustments, it has dropped ~3.2 mb/d seeing that March.

Most of the manufacturing drop is shut-in barrels, so we expect this to start recovering in June. For the time being, we've got June production improving lower back to ~11 mb/d with July quantity around ~eleven.five mb/d.

The lack of nicely completions will eat into the base production price as current basin decline pushes overall production lower. August must see US oil manufacturing flatlining around eleven.5 mb/d as well.

Obviously, those estimates could be situation to revisions, so we will hold a near eye on production figures going ahead.

For the time being, we've got no longer visible any meaningful recovery in associated gas manufacturing, which is a superb tale that oil manufacturing has now not rebounded meaningfully either.

Oil Price Rallies Ahead of Fundamentals

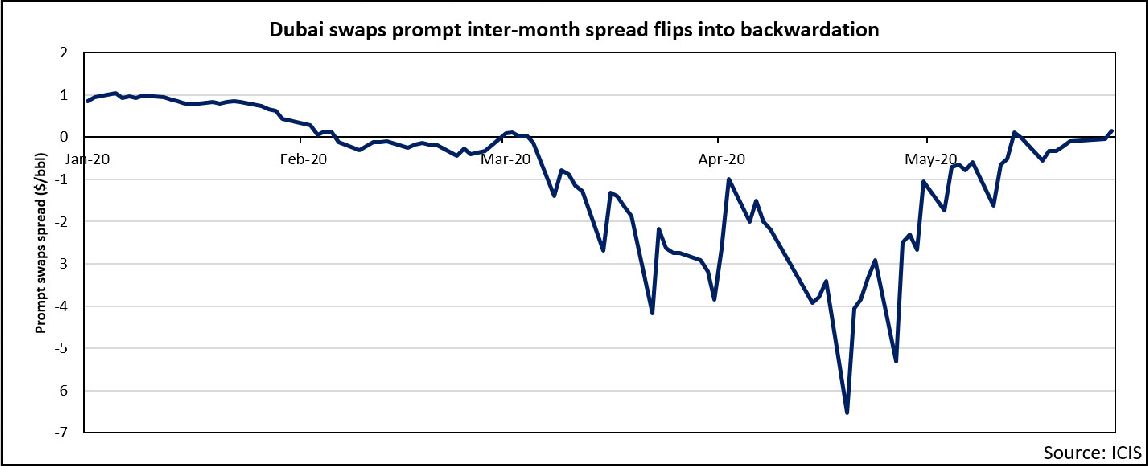

But the recent crude rally is going well past where basics are today. Refining margins are beginning to recover, however continue to lag the crude movement. While OPEC+ is set to agree on extending the ~10 mb/d reduce for a month or two, the issue comes all the way down to compliance. Global crude timespreads are starting to inch closer to backwardation, however without solid essential aid from higher refinery throughput, it will likely be very tough for the timespreads to hold.

As a result, the tempo of US oil manufacturing rebounding will play a big role within the subsequent rebalancing phase for the oil market. If US shut-in manufacturing returns too fast, we may additionally postpone the healing by way of any other month or two. Refinery throughput desires to increase to aid the boom in production, otherwise all the ones barrels will just be stored again.

So the ahead drivers of the oil market will retain to be:

Demand > product storage moving lower > refinery throughput shifting better > margins moving up > crude rallies > timespreads pass into backwardation > crude garage draw

If the order of the recovery is flipped in any way, it is going to be a choppy rebalance.

Over the weekend, we posted our worldwide oil deliver and demand outlook. We see a primary deficit taking form for 2021 and 2022 within the oil marketplace. Our oil fee projection in conjunction with our deliver and demand version suggests superb days ahead for the power industry. For the ones interested, we are now supplying a 2-week loose trial with a view to see for yourself.

More news

Libya restarts two major oil fields after long halt

Libya has restarted production at the El-Feel oil discipline after a five-month halt, just a day after oil commenced flowing again from the country's Sharara deposit.

Seadrill says another bankruptcy is an option - WSJ

Seadrill (SDRL -8.2%) tells WSJ that Chapter 11 financial disaster is on the table, an afternoon after CFO Stuart Jackson said the downturn because of the coronavirus and the Saudi-Russian oil price had compelled the business enterprise to abandon what became an "interim solution" to its debt woes and recognition on a complete restructuring.