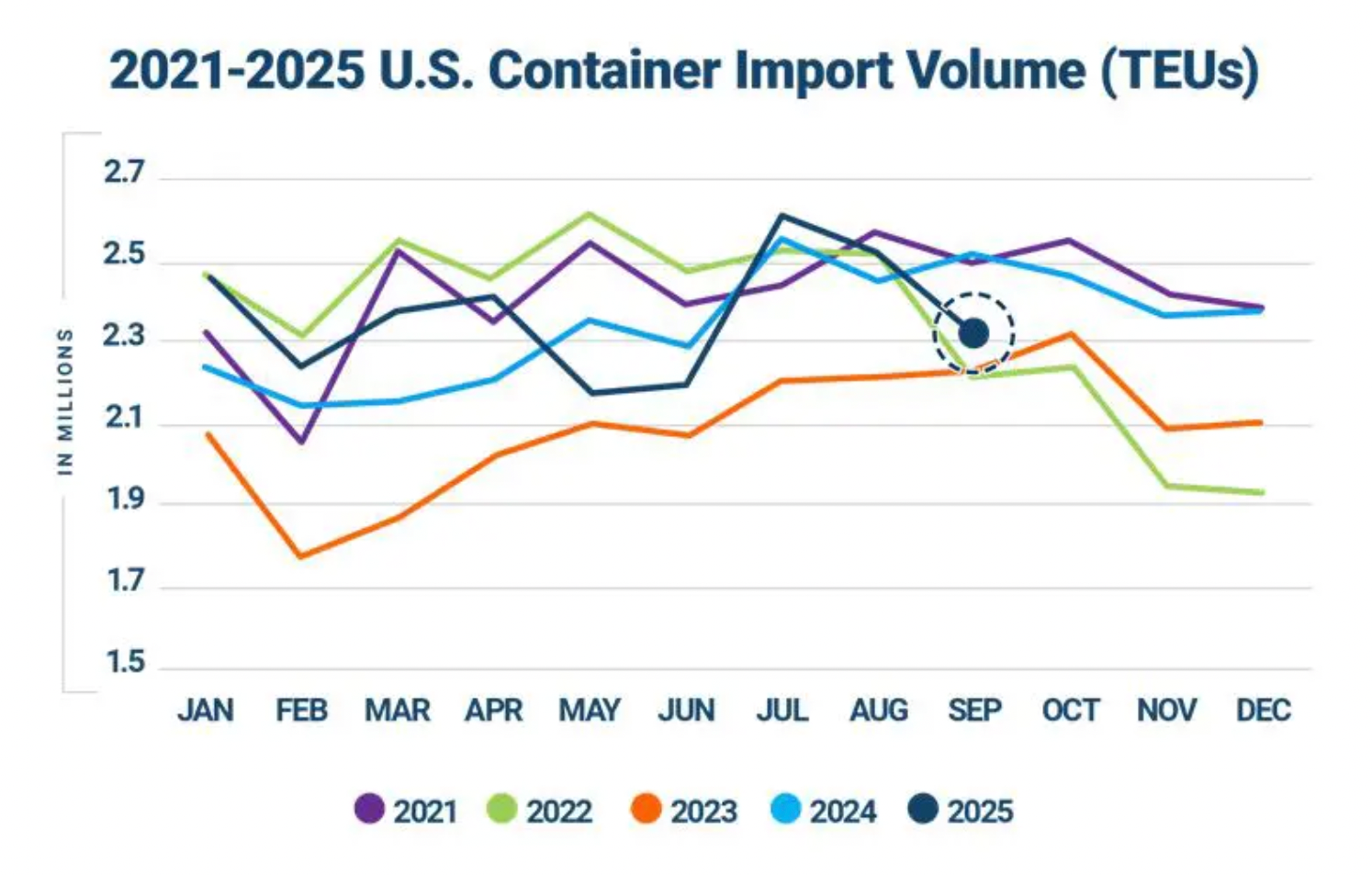

In September 2025, U.S. container imports dropped significantly, falling by 8.4% from August to a total of 2,307,933 twenty-foot equivalent units (TEUs), as reported by Descartes Systems Group in their October Global Shipping Report. This sharp decline marks the largest monthly drop in recent years, coinciding with ongoing uncertainty over tariffs that importers are facing.

Imports from China were the main contributor to this decline, decreasing by 12.3% from the previous month to 762,772 TEUs, which is a 22.9% drop compared to September 2024. Almost all major product categories saw decreases, with aluminum and related products experiencing the largest fall of 43.8% year-over-year. Other declines included footwear at 33.9%, electric machinery at 31.5%, and both knit and non-knit apparel categories fell by over 29%.

The furniture and bedding sector, which is the largest category of imports from China, saw a year-over-year decrease of 22.3%, but still accounted for 14.5% of all imports from China.

Jackson Wood, Director of Industry Strategy at Descartes, commented, “After two months of high import volumes, we saw a decrease in September, primarily due to a significant reduction in shipments from China. This decline highlights the effects of seasonal slowdowns combined with caution surrounding tariffs. With the 90-day tariff truce between the U.S. and China ending in mid-November, the share of U.S. imports from China remains vulnerable to both policy changes and market factors.”

While the decrease from August to September fits with seasonal trends seen in eight of the last ten years, this year's sharper drop suggests that importers are particularly responsive to upcoming tariff deadlines. Even with the reduction in September, imports for the year so far are still 1.9% higher than during the same time last year.

The report also found that imports from the top ten countries of origin fell 9.4% month-over-month, translating to a total drop of 169,126 TEUs. Other countries like Italy, South Korea, Germany, Hong Kong, and Taiwan also saw significant declines, with drops of 15.1%, 14.1%, 11.6%, 11.2%, and 10.2%, respectively.

This overall decline is occurring as new vessel fees under section 301 take effect on October 14, and as the end of the U.S.-China tariff truce looms on November 10, putting additional strain on imports from China. Port transit times showed mixed results with slight improvements in September despite the overall decline in volumes from August.

Descartes noted that the ongoing volatility in tariffs continues to create uncertainty in trade, while global supply chains are also dealing with persistent geopolitical disruptions.