By Gavin van Marle (The Loadstar) – This past week saw mixed signals regarding container spot freight rates from key indices, particularly the Shanghai Containerised Freight Index (SCFI), which showed significant differences compared to data from Drewry, Xeneta, and Freightos.

This week, the SCFI for the Shanghai-Mediterranean route recorded a 12% increase, bringing the spot rate to $3,966 for a 40ft container. This figure stands out notably among other indices.

The SCFI spread between Mediterranean and North Europe rates from Asia reached nearly $1,300 per 40ft, marking a 50% difference, with the Shanghai-North Europe spot rate at $2,698 per 40ft, an 8% increase week on week.

In contrast, Drewry's World Container Index (WCI) reported a 3% gain on its Shanghai-Rotterdam route, finishing at $1,795 per 40ft, while the Shanghai-Genoa route saw a 5% rise to $1,955 per 40ft, resulting in a much smaller spread of only $200.

Similarly, the average short-term rate on Xeneta’s XSI for the Far East-North Europe trade was $1,964 per 40ft, while the Far East-Mediterranean rate stood at $2,326 per 40ft.

One possible reason for the SCFI's discrepancies is that it is based on rate quotes for the upcoming week and may be anticipating a set of new FAK rates that carriers plan to implement starting tomorrow (November 1).

For example, MSC is set to introduce a new FAK rate of $2,700 per 40ft for the Far East to North Europe route, aligning closely with the current SCFI spot rate.

With the annual contract negotiations for the Asia-Europe routes entering the early stages, spot rates will likely play a vital role in determining shippers’ long-term rates for 2026, according to Peter Sand, chief analyst at Xeneta.

“Another increase in spot rates from the Far East to North Europe is anticipated on November 1, likely aligning with the average long-term rates in this trade,” he explained.

“We previously observed spikes in this trade on November 1 in 2024 and 2023, following declines. While it may seem coincidental, it’s more probable that carriers are managing capacity smartly and pushing to maintain rates during this critical period before contract tenders,” he added.

However, despite spot rates remaining steady throughout most of October, Xeneta pointed out that the Asia-North Europe rate is currently about 61% lower than at the start of 2024. That's the biggest drop among major east-west trades, while a source close to shippers told The Loadstar that “the carriers definitely weren’t feeling optimistic during my recent visit to Asia.”

Sand remarked, “Shippers need to keep a close eye on market changes every day because the recent rise in short-term rates doesn’t automatically imply that long-term rates for 2026 will increase as well.”

A quick survey among The Loadstar sources indicated that pricing for Asia-North Europe routes next year may be slightly lower than this year, estimated to be around $1,400-$1,500 per 40ft.

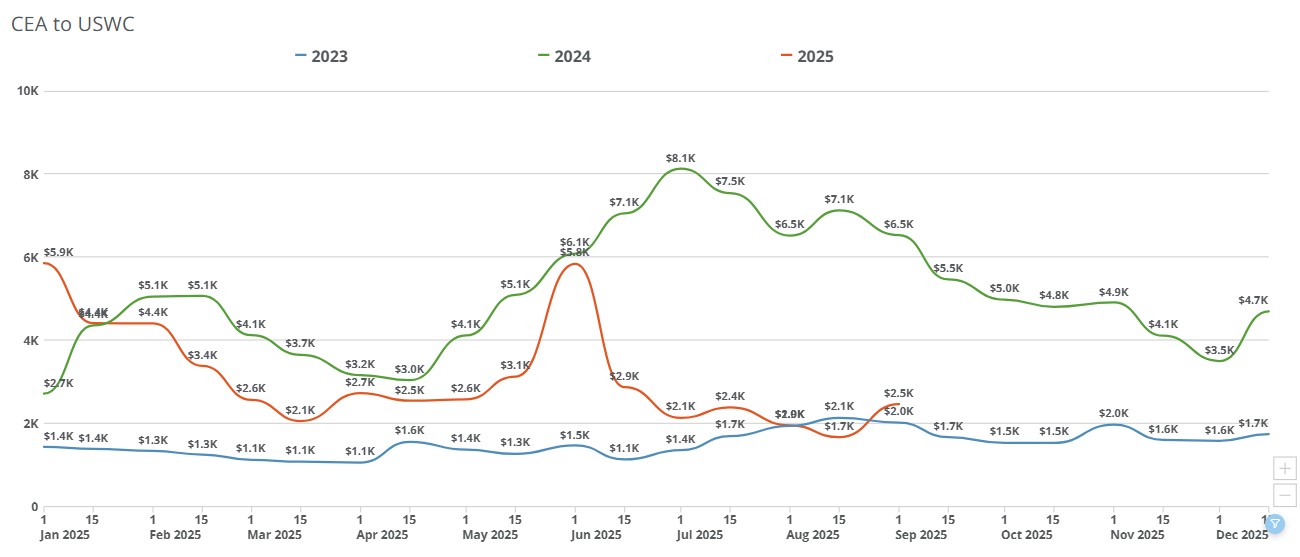

Similarly, transpacific trades saw a rise too, with the WCI reporting a 6% increase on the Shanghai-Los Angeles route to $2,438 per 40ft, while the Shanghai-New York route rose 4% to $3,568 per 40ft.

Drewry anticipates a slight rate increase next week due to the implementation of General Rate Increases (GRIs) on November 1. However, this increase may be short-lived as rates are expected to decline shortly after.

Several carriers are planning to introduce GRIs tomorrow, with increases ranging from $1,000 to $3,000 per 40ft.

A crucial question is how this week’s temporary tariff truce, stemming from a meeting between Presidents Trump and Xi in South Korea, will impact transpacific demand.

“Average spot rates rose in October and are projected to rise again on November 1, but this trend contradicts the underlying lackluster demand into the US,” Sand stated.

“The 12-month trade truce between the US and China announced this week could prompt some shippers to take action, but it’s unlikely to lead to a significant surge in imports. Many shippers have already stocked their supplies earlier this year, and with high inventory levels, they may not be in a hurry to benefit from lower tariffs.”

He concluded, “Market sentiment plays a significant role; while the US-China truce may not lead to an influx of cargo or further rate increases, it could exert some upward pressure to prevent rates from dropping too sharply in the remainder of 2025.”