By Alex Longley and Julian Lee — There is a huge amount of oil, around a billion barrels, sitting on the world’s oceans. A significant part of this oil comes from countries facing sanctions. This indicates that the sanctions are causing disruptions in the oil trade.

Since late August, the increase in oil on tankers shows that about 40% of this new oil comes from Russia, Iran, and Venezuela, or from sources that are unclear. Even at the lowest estimate, which is around 20%, this still represents a larger portion of global crude production than these countries actually produce.

This buildup of oil doesn't mean it won't be sold eventually. However, it poses a risk to the income of countries under sanctions and could lead to an oversupply in the global oil market. While the increase is partly due to higher production, it also indicates issues with unloading the oil. Additionally, there has been an increase in supplies from countries not facing sanctions.

The future of this crude oil in transit, whether sanctioned or not, will significantly influence oil prices in the coming months. According to traders, the latest Western sanctions are causing changes in oil flows, which could affect major importers like India and China. At the same time, a stretched tanker fleet has pushed daily shipping costs over $100,000.

“Some of this increase is due to tougher Western sanctions, which have left Russian oil stranded on ships and unable to discharge,” analysts from Clarksons Securities, including Frode Morkedal, noted. “Previous buyers have chosen replacements from the Middle East and the Atlantic.”

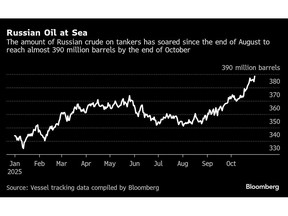

A Bloomberg analysis reveals that Russian oil is leading the increase in restricted supplies.

Russia's seaborne oil shipments have risen in recent weeks as the country increases production after earlier cuts with OPEC+ members. Some oil is likely being rerouted to export terminals because of Ukrainian attacks on Russian oil infrastructure, especially refineries.

At the same time, strict Western actions against buyers of Russian oil are preventing some shipments from being offloaded. Notably, Indian refineries are not accepting Russian cargoes, and China also appears reluctant to step in. The U.S. sanctions on Russia’s largest oil firms, Rosneft and Lukoil, have made it even harder to trade their oil.

According to Bloomberg calculations based on Finance Ministry data, Russia’s oil tax revenues dropped by more than 24% year-on-year last month. The Russian government expects this year’s revenue from oil and gas to be the lowest since the pandemic began in 2020.

Iranian oil shipments also hit a seven-year high in October, which coincides with U.S. sanctions on a major Chinese terminal for its role in buying Iranian oil.

OilX, a subsidiary of consultant Energy Aspects, explains that its data on oil at sea includes confirmed shipments from countries like Iran and Venezuela, which often face delays due to clandestine operations. This means that volumes could be revised upwards as better data becomes available. Vortexa mentions that its oil figures typically overestimate until the ships discharge, but the current situation is not typical.

It’s important to note that there is also a significant amount of non-sanctioned oil on tankers due to rising global production. According to OilX data, since late August, the largest contributor to the increase has been Saudi Arabia, followed closely by the U.S. and Russia.

Saudi Arabia exported oil at the highest rate in two-and-a-half years last month as it works to regain market share lost during years of production cuts by OPEC and its allies.

Similarly, U.S. crude oil amounts at sea have increased after shipments reached their highest monthly average since July 2024 in October. This rise occurred as Asian processors purchased U.S. cargoes over the summer due to higher Middle Eastern prices, a situation known as an arbitrage window.

However, oil from sanctioned nations forms a larger portion of the recent increase than their collective share of global crude production, which is about 17%, according to OilX data.

“It’s clear that a lot of crude is currently on the water,” said Brian Mandell, Executive Vice President of Marketing and Commercial at Phillips 66, during an earnings call last month. “We’re waiting to see what these crude supplies entail.”