In October 2025, there were thirty new orders for alternative-fueled ships, as reported by DNV's Alternative Fuels Insight platform. This marks a positive trend after a few sluggish months in the third quarter, even amid ongoing uncertainty about global emissions regulations.

The majority of the orders, 26 in total, were for LNG-fueled vessels, all from the container sector. The other four orders were for methanol-fueled ships, with three coming from the tanker category.

Even with the increase in October, the overall numbers for the year remain low. In the first ten months of 2025, only 222 alternative-fueled vessel orders were placed, which is just 52% of the totals from the same period in 2024. LNG-fueled vessels continue to lead, making up 67% of all orders this year, amounting to 147 ships. Methanol-fueled vessels follow with 47 orders, while 19 are for LPG carriers, 5 for ammonia-fueled vessels, and 4 for hydrogen-fueled ships.

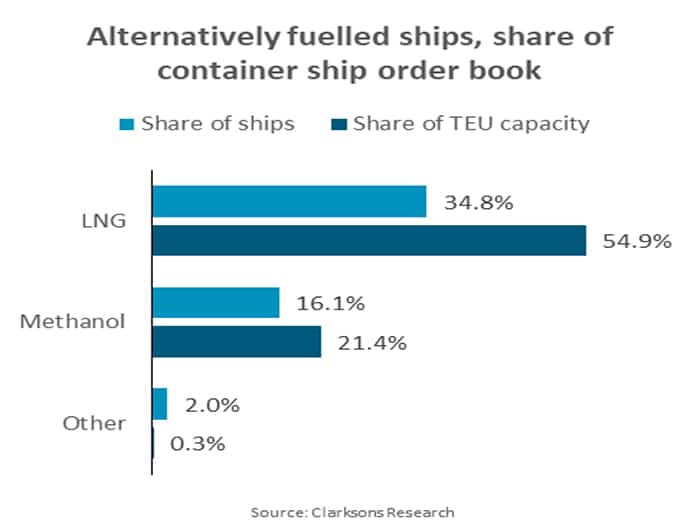

The container segment has become the main driver for alternative-fuel vessel orders, representing 65% of all new orders in 2025.

In October, there was also progress in infrastructure investment, with four LNG bunker vessels and two bunker vessels for methanol and biofuel added to the order book. Although these vessels are not counted among alternative-fueled ship statistics, they demonstrate a commitment to developing the new alternative-fueled fleet.

Jason Stefanatos, Global Decarbonization Director at DNV Maritime, expressed optimism about the recent improvements but noted ongoing difficulties. “It’s encouraging to see better numbers in October, both for vessels and in investments in bunkering infrastructure. Although activity is still below last year's levels, it’s important to recognize that this is occurring in a weaker overall newbuild market,” said Stefanatos.

Uncertainty in regulations has been a significant factor influencing market perceptions. Stefanatos previously pointed out that “confusion surrounding the IMO’s Net-Zero Framework, including lifecycle assessment factors for specific fuels, is causing many ship owners to adopt a ‘wait and see’ mindset regarding new orders.”

Last month, the IMO postponed the adoption of its Net-Zero Framework for an additional year due to pressure from the United States, Saudi Arabia, and other nations. The vote on this framework has been moved to October 2026. The goal of the framework is to decrease international shipping emissions to net zero by 2050 and to establish the first global carbon pricing system for shipping, potentially generating revenues of up to $15 billion annually starting in 2030.

“While regulatory uncertainties persist, efforts to decarbonize maritime activities continue, led by the container segment and supported by various stakeholders including cargo owners, financiers, and shipowners themselves. This ongoing dedication across the industry indicates that transitioning to cleaner fuels remains a priority,” added Stefanatos.

The IMO will hold technical working group discussions from April 20-24, 2026, followed by the 84th session of the Marine Environment Protection Committee from April 27 to May 1.